Does your neighbor understand the close relationship between federal deficits and economic growth? Do you?

Federal deficits and economic growth go hand-in-hand.

The lines parallel because of this formula:

Gross Domestic Product = Federal Spending + Non-federal Spending + Net Exports.

Increases in Federal Spending directly increase economic growth (GDP), but they also increase Non-federal spending by adding dollars to the private sector.

Thus, federal deficit spending is absolutely … necessary for economic growth.

Believe it or not, the government lies to you.

https://mythfighter.com/2023/11/20/believe-it-or-not-the-government-lies-to-you/

Federal “debt” isn’t federal, and it isn’t debt.

It’s deposits into T-security accounts that are wholly owned by the depositors and never invaded by the federal government. That’s right. The government doesn’t own or even touch those dollars. They belong to depositors.

The government merely holds them in safe keeping, like it holds whatever is in your bank safe deposit box.

To “pay off” the misnamed “debt,” the government merely returns the depositor’s’ dollars to the depositors. It does that every day.

Think about it. Do you really think the government of China would turn over ownership of billions of their dollars to U.S. government usage?

In summary, the Treasury supports the lie that the growing “Federal Debt/ GDP is in some way “unsustainable,” without ever saying what they mean by “unsustainable.”

There never has been a time when the U.S. government has not been able to “sustain” (whatever that means) its “debt” (whatever that means).

So why the lies?

For much of the government, it’s pure ignorance. The people writing this stuff simply do not understand Monetary Sovereignty.

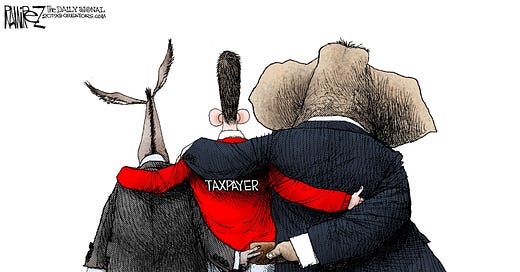

But for some, it’s malevolence, paid for by the rich who run America.

“Rich” is a comparative. There are two ways to become richer: Get more for yourself or make those below you have less.

A millionaire is rich if everyone else has a thousand dollars. But a millionaire is poor if everyone else has a billion dollars. It’s the income/wealth/power Gap that determines whether you are rich or poor.

Cutting the Debt/GDP ratio requires cuts to such programs as Social Security, Medicare, and/or other benefits for those who aren’t rich. Or it requires increases in FICA and income taxes — the taxes that most affect the not-rich. You seldom hear recommendations to reduce the tax loopholes enjoyed by the rich.

By impoverishing the middle and the poor, the rich make themselves richer. So, they bribe the media, the politicians, and the university economists to tell you your benefits must be cut and your taxes increased because “the current policy is unsustainable.”

They rely on the public’s ignorance about Monetary Sovereignty, and so far, that has worked.

Rodger Malcolm Mitchell

Monetary Sovereignty

We are not on a spinning ball.

There is no curve.

Similarly:

https://youtu.be/tTFDMFHs7Wc?si=ibiu9TgR7mMHCUTO