https://twitter.com/SamMaloneUK/status/422191610605359104

I saved the following two articles from Rodger Mitchell’s website, Mythfighter.com, in 2020, though the articles were posted some years before. I also saved some of the comments under the articles, because they helped me understand them better.

The end of private banking: Why the federal government should own all banks.

Mar 31 2012

_The reason to break up the TBTF banks is simple: They cannot be trusted to work in the best interests of the public. Breaking them up presumably would make them easier to control (regulate), and less likely to do damage.

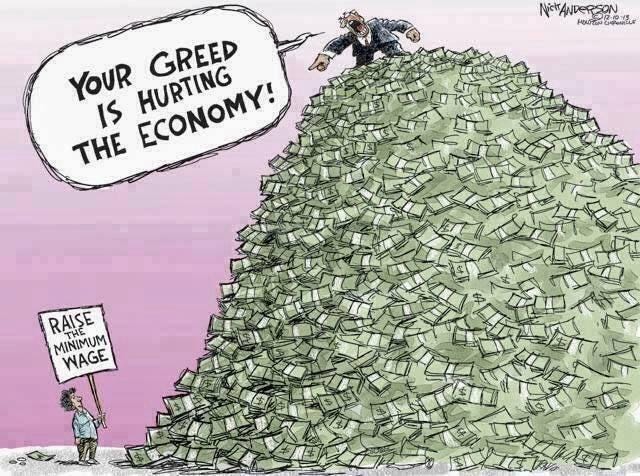

_Why can’t banks be trusted? Their motive is profits, not service to the public. Their misdeeds have caused the recession, damage to the economy and the growing gap between those people with high income (1%) and the rest (99%). Congressional conservatives will not supervise the bank’s insatiable thirst for profits, which motivates all bank activities. Damage control by the federal government has become an increasing need.

_All bank problems boil down to the profit motive. Rather than breaking up the TBTF banks into smaller, (hopefully) more controllable pieces, we should eliminate their fundamental problem, the profit motive. And, what better way to eliminate the profit motive, than to put banks under total government control, i.e. ownership?

Rodger Malcolm Mitchell

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption + Net exports

COMMENTS

Mark Robertson says:

January 16, 2013 at 10:21 pm

_Chasfra writes, “A site called Pragmatic Capitalism and its pet theory Monetary Realism seems to challenge the ideas contained in MS and to some extent MMT; who they state fail to recognize that private banks create the majority of money and not the Treasury Dept. or the Fed.”

_Yes, of course private banks create most of the money. Rodger has never said otherwise. And while there are many things about MMT that Rodger and I disagree with, the “Monetary Realism” people have never said anything that Rodger has not already said, many times.

_Let’s examine this specific topic once again…

_The US government creates its spending money on computer keyboards. Banks create loan money the same way. Bank loans are money, since loan money can be spent or deposited.

_Now, consider that America’s overall GDP is about $15 trillion each year. The U.S. government expects to spend $3.8 trillion for FY 2013. Right away we see that U.S. government spending is only about 25.3% of GDP. This figure is not entirely accurate, since the government will tax $2.9 trillion out of the depressed economy, and destroy it, but the 25% figure suffices to show that three fourths of America’s GDP consists of bank loans, plus financial investments and shenanigans, consumer spending, and so on. Only a quarter of the money supply comes from government spending.

_Currently the banks are not lending or investing, since banks can make more money by speculating, and through various forms of arbitrage. Moreover, if the banks lose on their bets, the Fed and / or the Treasury create more money on their keyboard, erasing the banks’ losses. So the banks have no reason to lend.

_Since the banks are not lending, we have a depression. When we have a depression, only three things can save us…

1. The USA becomes a net exporter to the world. (This won’t happen.)

2. Banks dramatically increase their lending. (Again, won’t happen.)

3. The U.S. government dramatically increases its spending.

_Rodger focuses on the third option, since it is the easiest to achieve, and the most viable. This focus may lead the casual observer to falsely think that Rodger says all our money comes from the government.

_The 1% and their puppet politicians want decreased government spending, so that we all become poorer, and more dependent on the 1% and politicians.

_And they have brainwashed 99.99% of the public into agreeing with them.

Gary Goodman says:

July 12, 2013 at 10:53 pm

_Vane, you better abolish Banking going back millenia to ancient Rome. Banks DO create money “out of thin air” by balance sheet expansion. Banks DO NOT pyramid money created by the Fed. That’s not how it works. Myth.

_Banks create loan proceeds (deposits) on balance sheets. On the other side of the balance sheet is the new Asset, the signed agreement.

_By this process, Banks create ZERO “NET” money, yet over 90% of money in circulation at a given time is outstanding bank credit that has not yet been extinguished.

_So some conservatives say the answer is to abolish Banking as it currently exists, to OUTLAW banking. But that, ironically, would be “govt tyranny”. It’s saying that this kind of business cannot accept an IOU and issue a deposit for the IOU which is a counter-balancing IOU (liability of the bank). Capitalism cannot grow and flourish without CREDIT. Credit is the means that makes today’s ideas and efforts become tomorrow’s profits, many months or years in the future.

_Ergo, without realizing it, Libertarian Ideologues would totally abolish Capitalism, achieve the dream of generations of Communist Ideologues long passed, by starving capitalism to death. Libertarian/Austrian purist ideology is economic Anti-Communism. Right? So being a mirror-image of extreme Marxism, Communism in Opposite-Land, it marches towards the same idiotic outcomes.

Rodger Malcolm Mitchell says:

September 6, 2013 at 3:44 pm

_Every form of fiat money is, and always must be, a form of debt. Since, by definition, fiat money has no intrinsic value, it must be backed by some form of guarantee. _That guarantee is the collateral that gives the money value.

_The U.S. dollar is a debt of the federal government, the collateral for which is the full faith and credit of the government. The holder of a dollar is owed U.S. full faith and credit.

_Thus, there never can be “debt-free” dollars.

_There can be, however, dollars that are issued without the concurrent issuance of T-securities, which are not collateral for anything. T-securities merely are bank accounts, essentially identical with savings accounts and CDs.

_In short, the federal government could spend without debt, by foregoing T-securities.

_As to whether the federal government or banks creates dollars, this is akin to the carpenter/hammer question: Is it the carpenter that drives the nail? Or is it the hammer?

_The government creates about 20% of the dollars in existence by paying bills, i.e. by sending instructions to banks, to increase the numbers in creditors’ checking accounts.

_Both are involved, but like the carpenter, the government makes the decisions, and like the hammer, the banks carry out the process.

_The other approximately 80% of the dollars are created by lending, most of which is done by banks.

Rodger Malcolm Mitchell says:

January 18, 2014 at 9:54 am

sucesofinanciero,

_Pretty nice paper. Mostly correct, but wrong in a couple key areas:

1. You said, “. . . supply and demand is an economic model of price determination in a market.”

_Correct.

_Then you said, ” . . . inflation is an event that leads to price increases. What is the event? An increase in the amount of money and/or credit.”

_Wrong. You forgot about demand. In fact, most inflations are demand-based, not money supply based (See: https://mythfighter.com/2010/04/06/more-thoughts-on-inflation/ )

2. You said, “the government sends instructions to make payments.”

_Correct. That is how the federal government creates dollars — by instructing banks to increase balances in checking accounts.

_And you said, “So it (Congress) passes a bill to send a trillion dollar check to each American family.

_Which creates money. Those checks are instructions.

_Then you said, ” . . . Congress essentially handed over their ability to create money.”

_Those three sentences are in conflict. The federal government creates money by sending instructions, and has not “handed over” its ability to create money. That said, banks create about 80% of the money supply by lending and Congress creates about 20% by spending.

3. You said, “The reason it doesn’t matter (whether taxes are destroyed) is because the population is forgoing purchasing power equal to the taxes paid, while the government is gaining it.

_Wrong: The government gains nothing. The government has the unlimited ability to send instructions to banks, so what could the government gain?

_Federal taxes and taxpayers do not fund federal spending. Federal taxes are destroyed upon receipt. (This is different from state and local taxes, which are not destroyed, and which DO fund state and local spending. It’s the fundamental difference between Monetary Sovereignty and monetary non-sovereignty.)

_This last is a very important point. Federal taxes could fall to $0, and still the government could spend as always.

_I’m afraid your conclusion is wrong: “This is proof that adding more currency not only not help the economy, it damages it. . . all deficit spending is damaging to the middle class and the economy.

_This false conclusion is based on your false belief that adding dollars causes inflation, but neglects demand.

_How would you grow demand in today’s economy, without adding dollars?

Gary Goodman says:

January 20, 2014 at 1:30 am

_You think there’s a difference if I issue a $1000 payment (credit) to your checking account from my checking acct, say for lawn maintenance, vs if I withdraw 10 x $100 bills or a stack of quarters and hand them to you in a sack.

_It’s the same thing, but MOST transactions these days are done by account credits (and debits) that amount to transferring money balances around the private banking system.

_When you get your paycheck, the employer’s acct balance is debited and yours is increased. Odds are, when you get $1000 in cash or coins, you will take that to your bank and deposit it. If you keep it in your wallet and spend it, then some other recipient or business will eventually deposit that and it will become a bank balance again.

_Nothing evil there.

_Banks create money (loans) out of account balance spreads, BECAUSE they have the legal right to maintain and uphold account balance records for individuals and companies. Therefore, besides clearing payments, they can credit your account or designee with loan proceeds (a liability of the bank) and hold onto your loan agreement (an asset of the bank).

_That’s not evil, per se. It MAY be considered usurious on several levels, because the interest charged seems to be “as if” they were lending out real capital they own, not merely expanding their balance sheets (more assets, more liabilities, simultaneously).

_One way to reduce this usury is for Uncle Sam to spend MORE than the current 20%, and structure tax laws and incentives so banks will lend less than 80%. MMT has various proposals. Point being, more “deficit spending” means more MONEY in the economy that is not the result of someone taking out a bank loan.

_Since unchecked bank lending CAN lead to a Bubble (intentional inflation, but of prices of assets owned by investors, not growth in wages) beyond anything sustainable by borrowers (see Steve Keen on Minsky and Ponzi Finance), the Govt needs to regulate to hold Finance in check, since Big Finance cannot actually function properly without govt backing … that was a solution a long time ago. The problem is, as usual, they want to HAVE their CAKE of govt backing, but they also want to EAT their CAKE, without sane regulations or limits.

Rodger Malcolm Mitchell says:

February 24, 2014 at 1:38 pm

_He says, “Private banks cannot create money.”

_Wrong. In fact, private banks create 80% of the U.S. money in existence. They do it by lending. Bank lending is limited only by a multiple of bank capital. A bank with a billion dollars in capital can led several billion. Where did the money come from? The banks created it.

_He says, “. . . excessive money creation in the U.S.A., the E.U. and China, was one of the main causes of the current crisis.”

_Wrong, again. The crisis was caused by bad lending. When a loan is made, money is created. But when a loan goes bad, that money is destroyed. The crisis was caused by money destruction, and the crisis was ameliorated somewhat by federal money creation.

_Then he gives examples involving gold — truly ridiculous examples, since gold is irrelevant in today’s finance. It’s just another commodity, no more meaningful than silver, tin, lead, coal or water.

_Further, the existence of a gold standard has one silly function: It reduces the possibility of economic growth, and increases the possibility of gold-shortage crises.

_Then, he favors, “a law requiring governments to have on average budget surpluses.” Since a government surplus is an economic deficit, he is advocating an economy that continuously is losing money — a guaranteed prescription for depression.

_Finally, he focuses on what he terms “inflationary money.” Inflation was not at all a factor in the crisis, and continues not to be a factor, despite massive deficit spending.

_Bottom line: Aside from being wrong at every step, and clearly not understanding the basics of economics, the author probably is a nice fellow.

Rodger Malcolm Mitchell says:

July 8, 2014 at 6:37 pm

_You just disproved your own “only one issuer” hypothesis.

_All U.S. banks create dollars by lending. Those dollars are backed first, by the borrowers’ and then by the federal government’s full faith and credit.

_You too can create dollars — by borrowing. First, your full faith and credit (which might include your house, if it’s a mortgage) backs the debt, and then, the federal government’s full faith and credit, backs those dollars.

_As for bitcoin, think about this: What gives them value? The full faith and credit of the system.

_If the system had no full faith and credit, bitcoin would have no value.

Is the U.S. truly Monetarily Sovereign?

Sunday, Nov 16 2014

Rodger Malcolm Mitchell 11:17 am

_Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

Is the U.S. government truly Monetarily Sovereign?

_In one sense this may seem to be a question of semantics, but it goes deeper than that.

_The citizens of a Monetarily Sovereign government primarily use for their money, the sovereign currency of that government. So U.S. citizens use the dollar, the sovereign currency of the U.S. And UK citizens use the pound, the sovereign currency of the UK.

_By contrast, Illinois citizens use the dollar, which is not the sovereign currency of Illinois (Illinois has no sovereign currency). And citizens of France use the euro, which is not the sovereign currency of France.

_So we say the U.S. is MS and France is monetarily non-sovereign.

_That is not to say, however, that the U.S. always acts as though it were MS. We have the nonsensical debt limit laws, which can prevent the U.S. from paying its bills just like a monetarily non-sovereign government.

_And we have the nonsensical Congress and President, who continually try to cut federal deficits and debts, as though the U.S. were monetarily non-sovereign.

_But there is even more monetary non-sovereignty buried in our MS government, and that has to do with banks. Dollars are created primarily in two ways: Private bank lending and the federal payment of bills.

_Under any dollar definitions (M1, M2, M3, L, Credit Market Instruments), private bank lending creates the vast majority of dollars, about 80% (again, depending on definitions). So immediately, one could say the U.S. government is not sovereign of the dollar if private banks create most of the dollars.

_But it gets even “worse.” When the federal government pays a bill, it sends instructions (not dollars) to the creditor’s private bank, telling the private bank to increase the balance in the creditor’s checking account.

_At the moment the private bank follows those instructions (and not before), dollars are created. In fact, the federal government doesn’t send dollars anywhere. It sends instructions (checks or wires) and it sends receipts (paper dollar bills).

_So in that case, who actually “creates” those dollars, the federal government through its instructions or the private banks by following those instructions?

_Scott Baker wrote an article titled, “Is this the end of debt-money at last?”, that discussed money creation in general, but contained one sentence I found especially interesting: “No nation can be truly sovereign if it cannot create its own money.”

_[Incidentally, there is a good explanation of money creation at this video: Money in a Modern Economy]

_By that measure, the only way the U.S. could become truly (or more) sovereign over the dollar is if all banks were federally owned, which just happens to be Step 9 in the “10 Steps to Prosperity.”

_There is no public purpose served by private banking. See: The end of private banking and How should America decide “who-gets-money”?

_In summary, Monetary Sovereignty is a comparative, not an absolute. The U.S. is Monetarily Sovereign when compared with state and local governments, euro governments, businesses, you and me. But it could and should be more MS. That would require, for instance, federal ownership of all banking functions.

_Equally important, it would require the President, Congress, the media and the mainstream economists to stop telling the Big Lie: the lie that federal deficits and debt are “unsustainable, and the lie that the federal governments spends “taxpayers’ money.”

_The economy requires federal deficits. The debt is meaningless. And the government does not spend taxpayers’ money.

_Rodger Malcolm Mitchell

COMMENTS

elizabethharris001 says:

July 25, 2016 at 2:52 am

[1] “Treasury borrows FRNs from the Fed to spend into circulation.”

That is Ellen Brown and the “positive money” people talking. They falsely believe that all money is created by banks as loans.

Banks do indeed create money when banks make loans, but the U.S. government likewise creates money when it spends. The U.S. government does not borrow its spending money from the Fed, or from bankers, from China, or from anyone else.

[2] “In addition to paying back the principal amount (of the bonds), interest must also be paid. But the interest has not yet been created. More must be borrowed in order to obtain the amount needed to pay the interest.”

No. When you buy a T-security, your purchase money is debited from your checking account, and is credited to a Fed savings account in your name. When your T-security matures, the process is reversed. Your Fed savings account is debited, and your personal checking account is credited by the amount of the security, plus the interest. In this way the Fed creates interest money out of thin air.

Consider a sports scoreboard. Its points have no physical existence, and therefore have no physical limit. By changing the numbers on the scoreboard, we create points out of thin air, and we send points back into thin air. The U.S. government creates and destroys money in exactly the same way.

In addition to this, banks create money out of thin air by making loans. Loan money is sent back into thin air (i.e. zeroed out) when the loan is paid off. Banks make their profit off the interest paid on the loan.

Many people falsely believe that bank lending is the ONLY way that money is created

[3] “More money thus disappears from circulation than existed in the principal of the original bond. The process is therefore deflationary removing more money from circulation than that which exists. Until the people become creators of their own currency and credit we are debt slaves to the usurers. Outlawing usury solves the problems of monetary deflation and price inflation.”

The people (or at least their representatives) already create their own currency. It is called U.S. government spending.

-----

Incidentally, currency is not money. Currency merely represents money. Currency can be spent or saved like money, but actual money (true money) only exists in the human mind, and can be represented by numbers on bank ledgers, or by tokens that we call currency.

Likewise on a scoreboard, the numbers are not points. The numbers merely represent points. Actual points only exist in the human mind.

The reason why bankers, rich people, and their puppet politicians have power is that we stupidly let them control the scoreboard.

Rodger Malcolm Mitchell says {to another commenter, not Liz Harris}:

November 14, 2017 at 10:32 pm

Sos,

_You wrote, “The numbers you see in your account reflect dollars not there.”

_I’m sorry that you have spent your whole life in banking, and still believe money is some physical thing that is “there” or “not there.”

_Dollars have no physical existence. They are nothing more than numbers. My savings account balance is the same as a check or a dollar bill. They both only represent dollars.

_My bank account balance is part of the nation’s money supply. It is dollars. It does not fall when the bank lends.

_You said, “. . . banks take in deposit and lend 90% of it, so effectively deposit accounts are not funded until you need the money.”

_Now think very carefully: Let’s say that a “90% loan” totals $10,000. How does a bank lend that 90%? It marks up its customer’s account by $10,000. No other customer’s account is reduced, so at the instant the bank marks up the borrower’s account, the bank’s total deposits go up $10,000.

_Now, the bank is able to lend another 90% of that 10,000, or $9,000, which it deposits into another customer’s account. The bank’s reserves go up

$9,000. Then, it lends another 90%, or $8,100, which increases bank deposits by $8,1000. And on and on, lending $7,290, $6,561, $5,905, etc., etc., etc.

_With each loan, the nation’s money supply rises.

_WHERE DID ALL THOSE ADDITIONAL DOLLARS COME FROM?

_The bank created them from thin air. That is the way most of the dollars in existence have been created — by bank lending.

Rodger Malcolm Mitchell says:

January 18, 2017 at 5:02 pm

_OMG! The man thinks Democrats are socialists. Clueless. Doesn’t understand the difference between a socialist (government ownership) and a progressive (government support for the less wealthy). Totally different.

_And he says, “If you or I “spent money into existence” it would be called counterfeiting and would be considered theft. Somehow when the government does this, it is okay and according to MMT stimulates the economy (creates wealth).”

_Yikes! It’s OK because that is the law. But what this guy doesn’t recognize is: You and I do spend money into existence, every time we use a credit card, every time we take out a mortgage, and every time we use a travelers check.

_Further, you are perfectly entitled to create your own money, call it “Galts,” and spend it as you wish. You only must get people to accept your full faith and credit, which is exactly what all money requires, whether it be dollars, pounds, lira, yen, etc.

_No law against “Galts.” Companies create their own money by issuing coupons.

_And as for confusing money with wealth, in economics, everything depends on definitions. How does he define “wealth”? If you had a trillion dollars, would you be wealthy?

_Oh, the hits keep coming. He said, “My earlier article on Banking shows that banks create money when they create loans, which any MMT advocate should know.” Name one MMT advocate who doesn’t know this.

_Dumbest statement yet: “I pointed out that legal tender laws were necessary for the government counterfeit money.” He better look up the word “counterfeit.”

_Clearly, the author is confused. Sadly, the author is confusing his readers.

_Economics is a protoscience where every damn fool with no background or education, has a strong opinion. This article is a perfect example.